Travel Smart: Save money on forex exchange

I hope this blog post will be useful to all who travel abroad for holidays now and in the future. At the moment, there are three main UK-based companies that offer fair exchange rates and a large number of various currencies to use: Wise and Revolut.

So how to save money on the forex exchange. Which company gives the best rate for the same 1,000 EUR?

Wise, previously known as TransferWise, is a financial technology company focused on global money transfers. Headquartered in London.

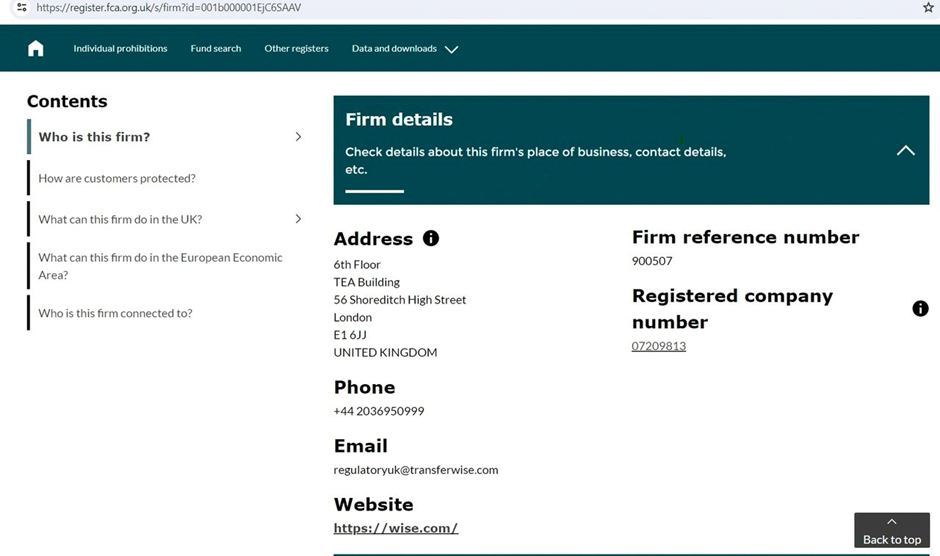

Wise is FCA registered in the UK, which means your funds are secured by the Financial Conduct Authority. Here is a link to How FSCA (Financial Service Compensation Scheme) protects your money. For any financial dealings, always check this is in place, the protection usually covers up to 80,000 pounds.

Physical cards will cost one-off 7 pounds, digital card is offered for free.

You can have free cash draws up to 200 pounds per month, after that you pay 1.75% charge.

The way I use is it if I open an account in a currency I need, for example, EUR, and then I convert from my GBP Wise account to EUR Wise account at the rate I want. Wise offers auto conversion at the rate that you need. So far I have not seen this option elsewhere.

When you use a card in France or Spain, the payment will be automatically taken from your EUR account without any charge. So basically, it is like using a local card there.

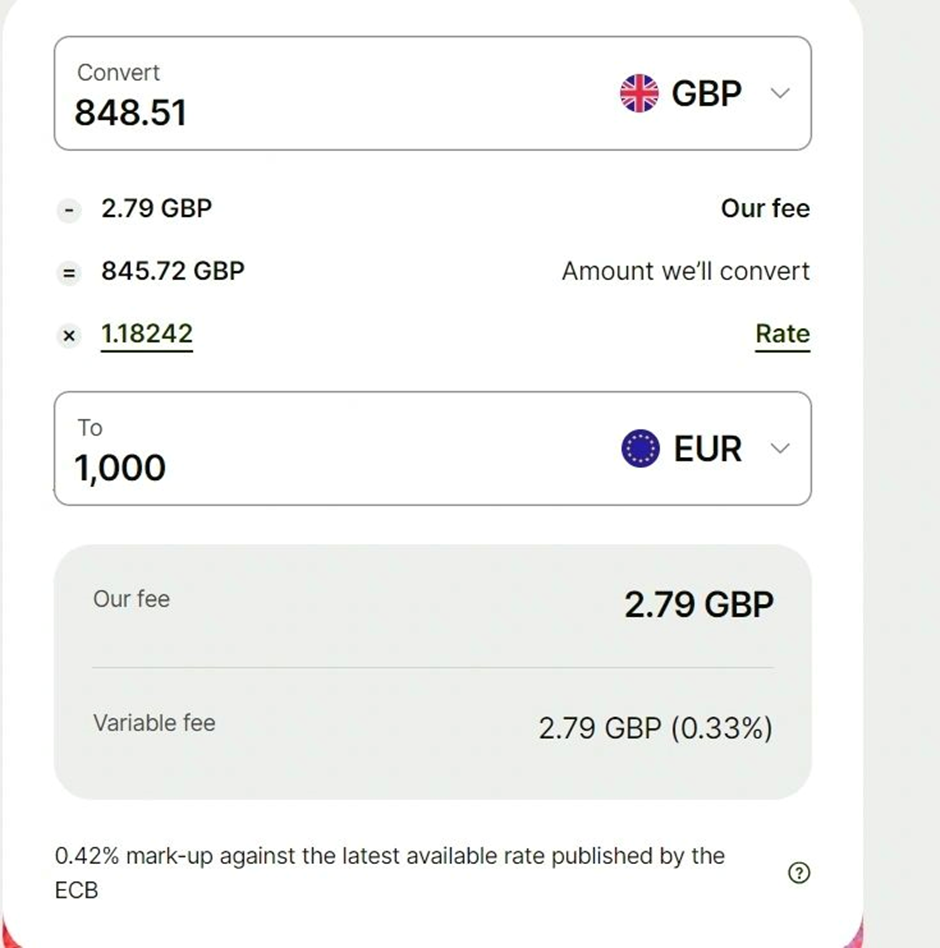

How much is conversion? At the moment of typing 0.33%, so if you exchange 1,000 pounds into EUR, you will get 1,178.52 at a rate of 1.18241 (09th July 2024).

I also recommend using their service for transfers abroad.

Revolut is a global neobank and financial technology company with headquarters in London, UK

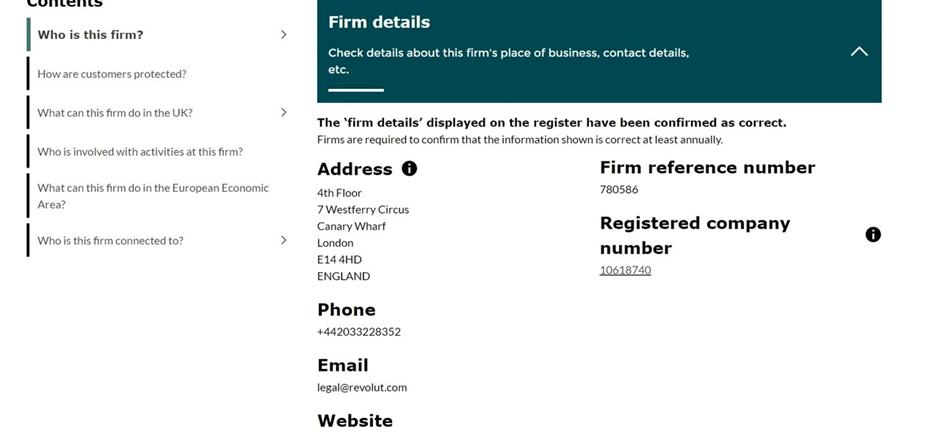

Revolut is similar to Wise offering card service to use abroad, registered with FCA. There are also digital and a physical card, as well as multiple international accounts that you can add.

For both, there are some currencies not open. I had a situation when Malaysian currency was not on Wise, so I used Revolut instead.

The difference is a subscription basis: standard (free) with up to 5 free withdrawals up to 200 pounds; then it costs from 3.99 to 45 per month.

I have not used anything but standard and I have everything I needed.

Word of warning. Once I arrived in Turkey on Sunday and had to pay at the hotel. To my surprise, Revolut charges extra for exchanging over the weekend.

However, Revolut (on weekdays) does not charge any fee for converting up to 1,000 pounds.

I like both cards, these are so handy for many reasons when travelling or sending money abroad.

How about using the retail banks

I bank with Halifax, so going to give their example of using the UK card abroad.

The charge is 2.95% for the foreign transaction fee plus some unfavorable exchange rate applied to your transaction. Maybe when I have no choice I would use it. That was for a debit card, and if you are using a credit card it is 2.99% for the foreign transaction fee, plus a 0.5 conversion fee.

Let’s compare

I need 1000 to spend on hotel booking in EUR.

Wise: 848.45 pounds (spend 2.79 on conversion, then nothing)

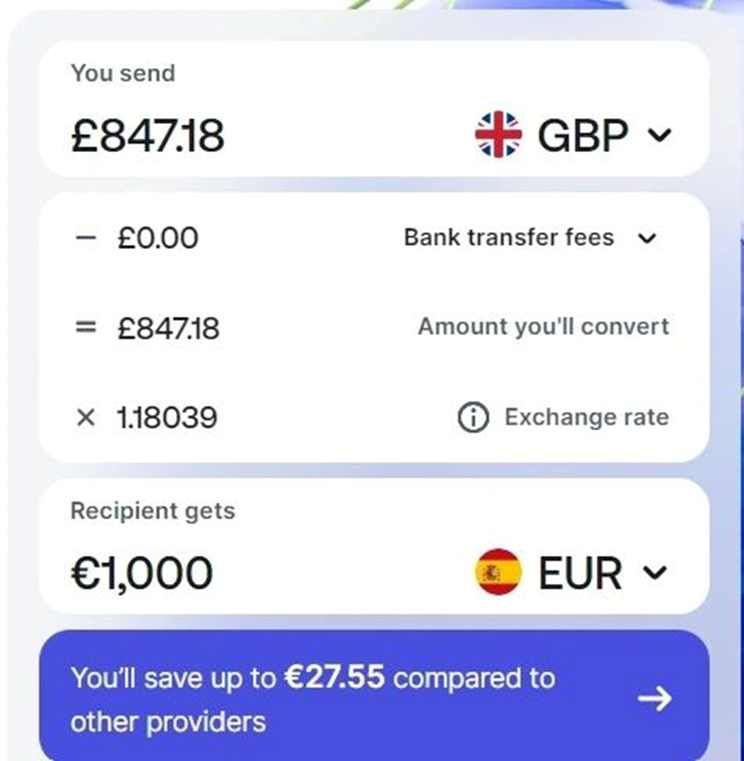

Revolut: 847.18 pounds, no charge

Halifax: 2.95% for 1,000 = 29.50 charge, I stop here.

In the case of Revolut and Wise, it is the same.

I would NOT recommend exchanging at the airport when you arrive, this is the most expensive mistake as you get much less.

If you need cash for a trip over 200 pounds per month, I would use Travellex. https://www.travelex.co.uk/

Here is how you save money on exchange rate whether if you are sending money abroad or use during your travels.

Revolut for 1,000 EUR

Wise for 1,000 EUR

Share this post